nj property tax relief 2018

NJ Division of Taxation Subject. The States other significant dedicated revenue the PPGRT is up 707 percent through the end of May 4740 million above the same point last year due to a statutory tax rate increase.

Nj Property Tax Relief Program Updates Access Wealth

And Murphys budget for the fiscal year that begins July 1 doesnt include enough cash.

. One of New Jerseys top property tax relief. The deadline for 2021 applications is October 31. 2018 New Jersey gross income.

When Did You Send Your Application. Ad Prepare and file 2018 prior year taxes for New Jersey state 1799 and federal Free. Eligibility requirements including income limits and benefits available under this program are subject to.

Everything is included Prior Year filing IRS e-file 1099-MISC and more. 75000 for homeowners under age 65 and not blind or disabled. We will automatically waive the late filing penalty for a corporation business taxpayers with a properly extended federal return due date of October 15.

Credit on Property Tax Bill. Ad Explore The Steps You Need To Take And Relief Options Available To You. If you were not a homeowner on October 1 2017 you are not eligible for a Homestead Benefit even if you owned a home for part of the year.

Applicants were eligible for reimbursement payments only if their total income was 70000 or less the original limit was 87268 and they met all the other program requirements. How Homestead Benefits Are Paid 2018 Homestead Benefit. All property tax relief program information provided here is based on current law and is subject to change.

Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses. Check Issued on or Before. The GIT which is dedicated to the Property Tax Relief Fund is up 94 percent year-to-date in FY 2018 1125 billion above the same point last year.

1The amount appropriated for property tax relief programs in the State Budget for FY 2019 affected income eligibility for 2017. The Philadelphia nonresident wage tax rate for 2018 was 34654 034654 from January 1 to June 30 and 34567 034567 from July 1 to December 31. The 2016 income requirements were that you had to earn less than 150000 for homeowners who are age 65 or.

Under New Jersey law if you owe money to New Jersey any of its agencies or the Internal Revenue. You are not eligible unless you are required to pay property taxes on your home. Homeowners Verification of 2018 and 2019 Property Taxes For use with Form PTR-1 Keywords.

To be eligible for 2021 property tax relief in New Jersey via the Homestead Benefit Program you must meet all the following requirements. If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. The amount appropriated for property tax relief programs in the State Budget does not include funding for 2018 tenant rebates.

The State of New Jersey has provided a web page for residents to access information about property tax relief. All property tax relief program information provided here is based on current law and is subject to change. Property Tax Relief Programs.

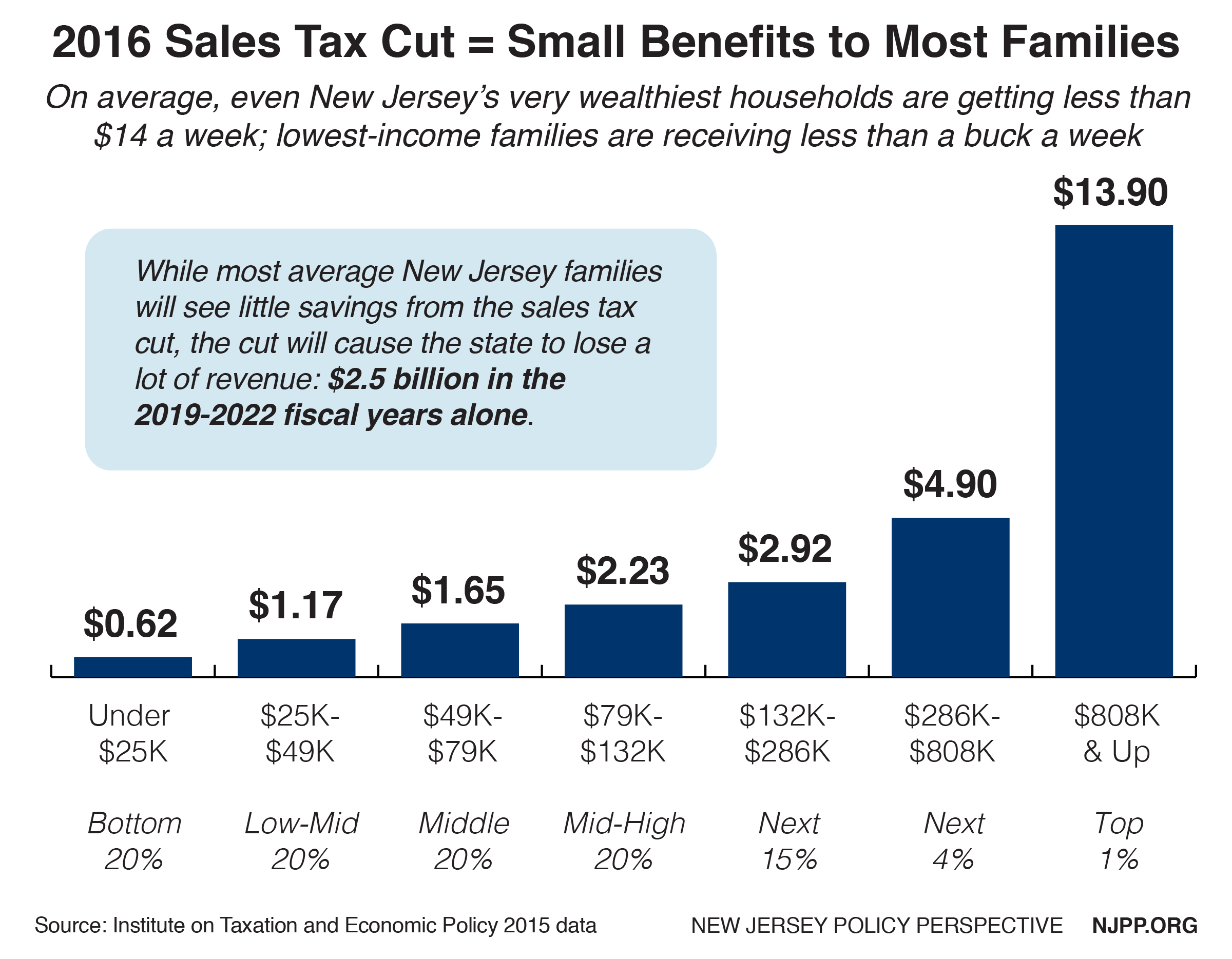

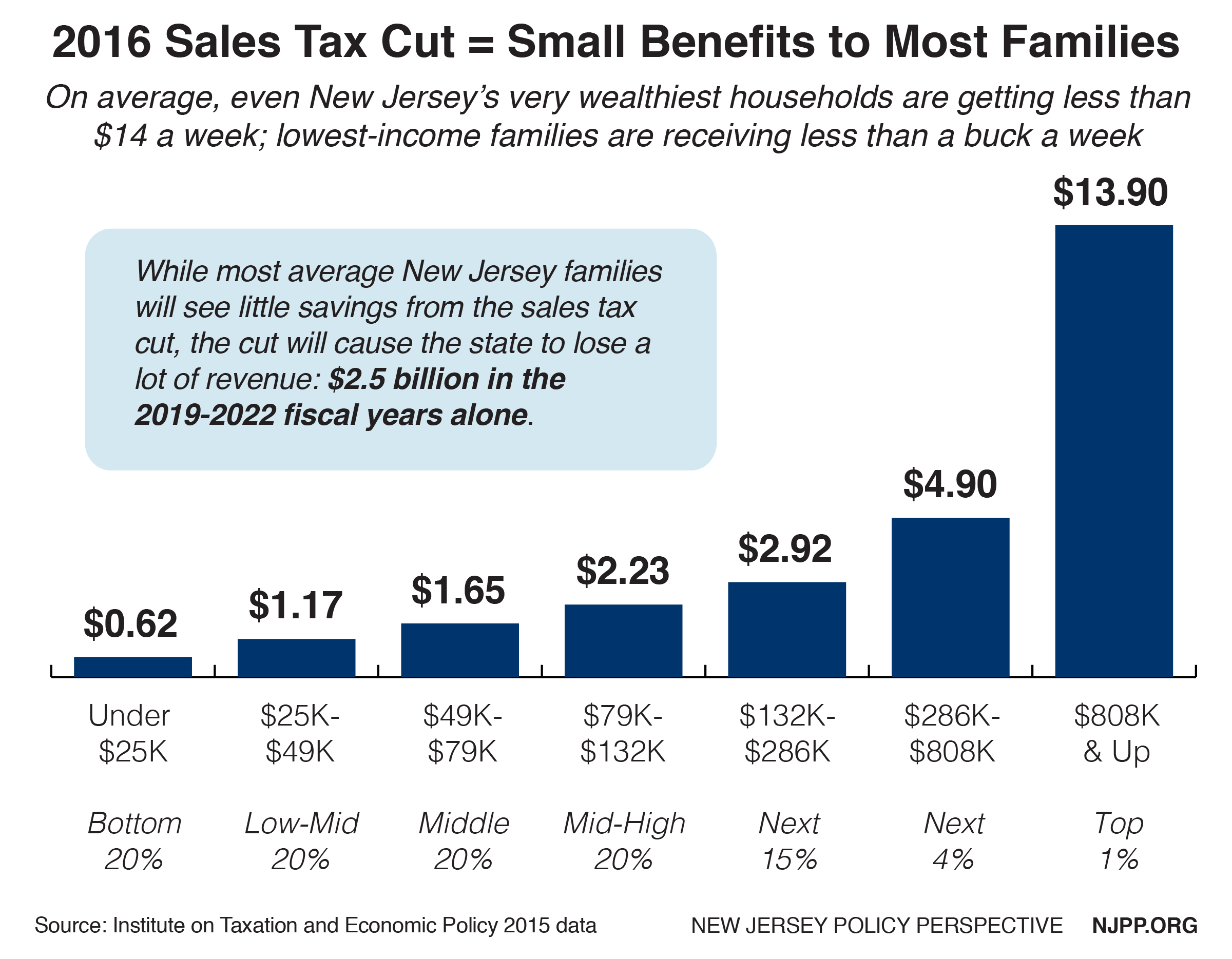

There is no partial year credit if you were not living in the home as of Oct. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and. On January 1 2017 the tax rate decreased from 7 to 6875.

In each case the homeowner must use the same filing status used on their 2018 New Jersey Income Tax returns. Have a copy of your application available when you call. Before May 1 2018.

30-Day Penalty Relief for Corporations for 2018. Property Tax Relief Programs Homestead Benefit. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Property taxes for 2018 were paid on that home. Homeowners Verification of 2018 and 2019 Property Taxes For use with Form PTR-1 Author. The amount varies according to the amount of the taxpayers NJ taxable income.

The New Jersey tax credit is a percentage of the taxpayers federal child and dependent care credit. October 31 2018 Reimbursement Checks. Your primary residence whether owned.

On January 1 2018 and after the tax rate will decrease to 6625. The Homestead Benefit program provides property tax relief to eligible homeowners. New program set to launch in NJ.

How Homestead Benefits Are Paid. Under the new program known as ANCHOR homeowners making up to 150000 will receive 1500 rebates on their property tax bills and those making 150000 to 250000 will receive 1000 rebates. You can print a paper application or electronically file one using your ID and PIN.

You are eligible for a property tax deduction or a property tax credit only if. Tax Debt Relief - What Are Your Options - Payment Plans and How Do They Work. You can still file for the 2021 Senior Freeze.

Property Tax Relief Programs. The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the. You can attach your supporting documents with the application.

You were a New Jersey resident. The Emergency Rescue Mortgage Assistance. We will continue to monitor the situation and will.

2018 filing status single. For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. If you owned more than one property in New Jersey only file the application for the property that was your principal residence on October 1 2018.

You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax year. Between May 2. Prior to the new 51 billion budget the average property tax benefit was 626 with eligibility limited to homeowners making 75000 or less.

We do not yet know if there will be a property tax rebate for 2018 as the credits are usually a few years behind. Additional information on the Sales and Use Tax changes is available online. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022.

2021 Senior Freeze Applications. 3 rows If your 2018 New Jersey Gross Income is. Prior Year Homestead Benefit Information.

Rate Reduction The New Jersey Sales and Use Tax is being reduced in two phases between 2017 and 2018. All property tax relief program information provided here is based on current law and is subject to change. The extended filing date for the 2018 New Jersey Corporation Business Tax Return on October 15 2019 is the same due date as the federal return.

New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Modernizing New Jersey S Sales Tax Will Level The Playing Field And Help The Economy Thrive New Jersey Policy Perspective

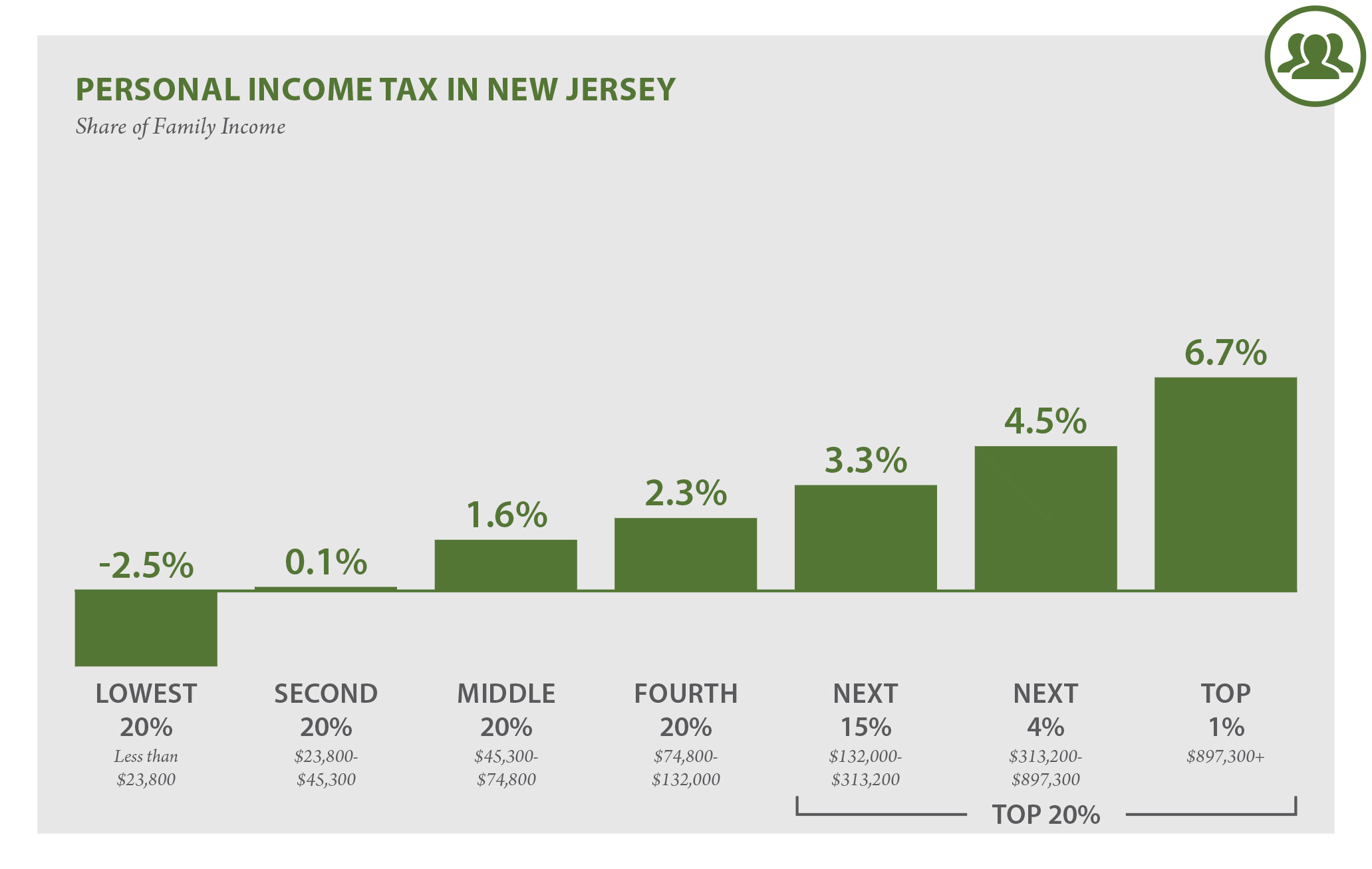

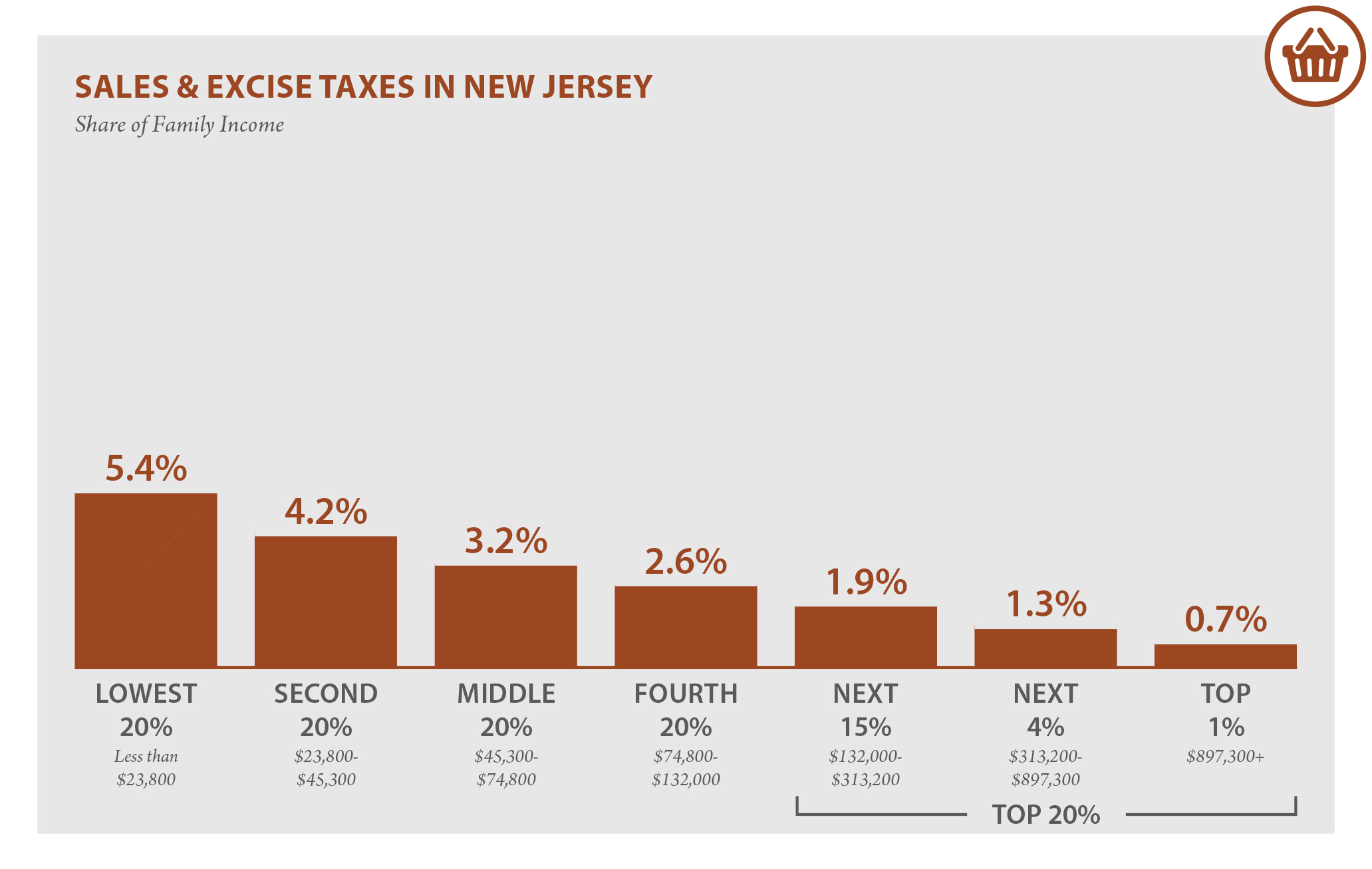

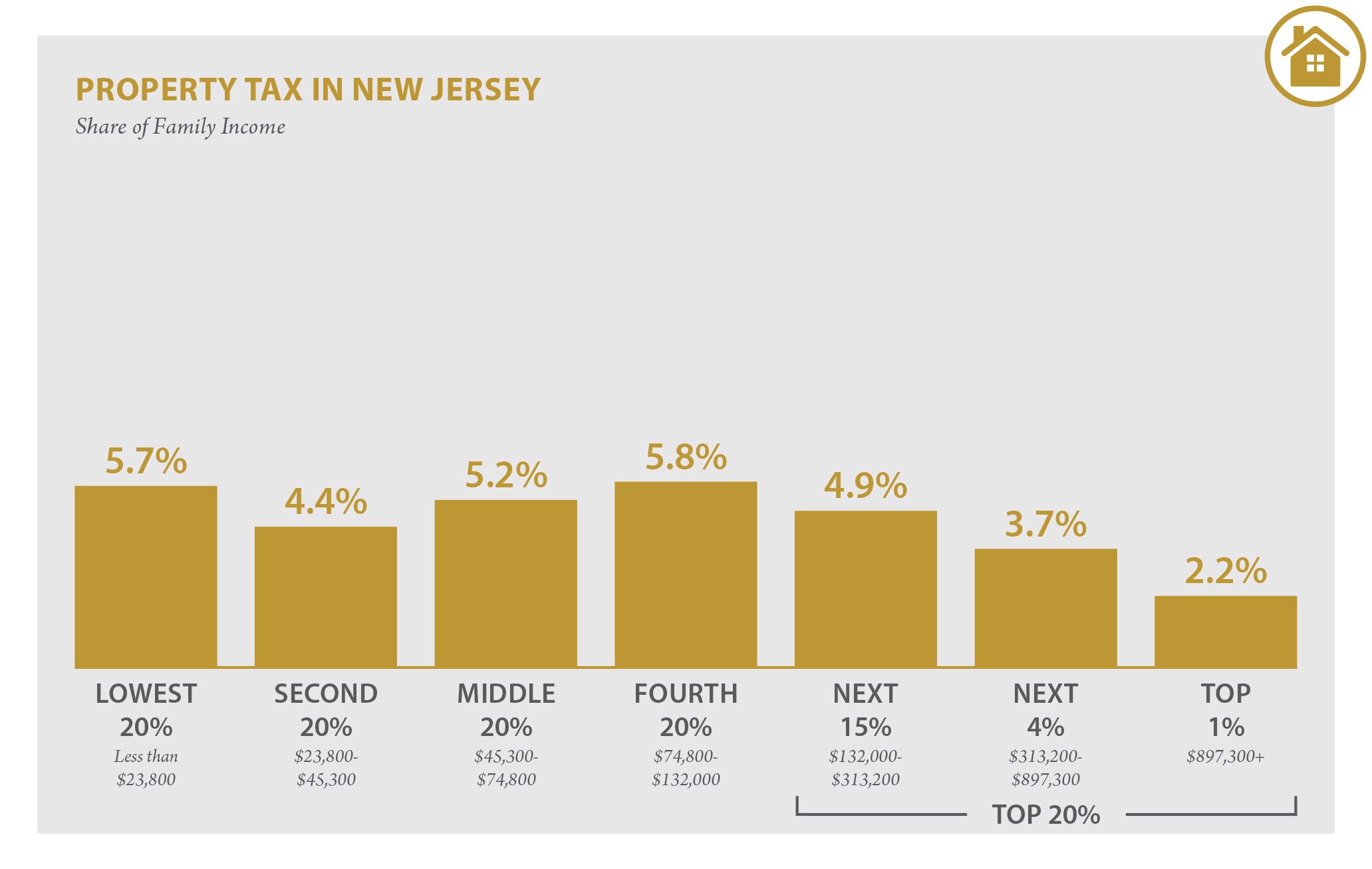

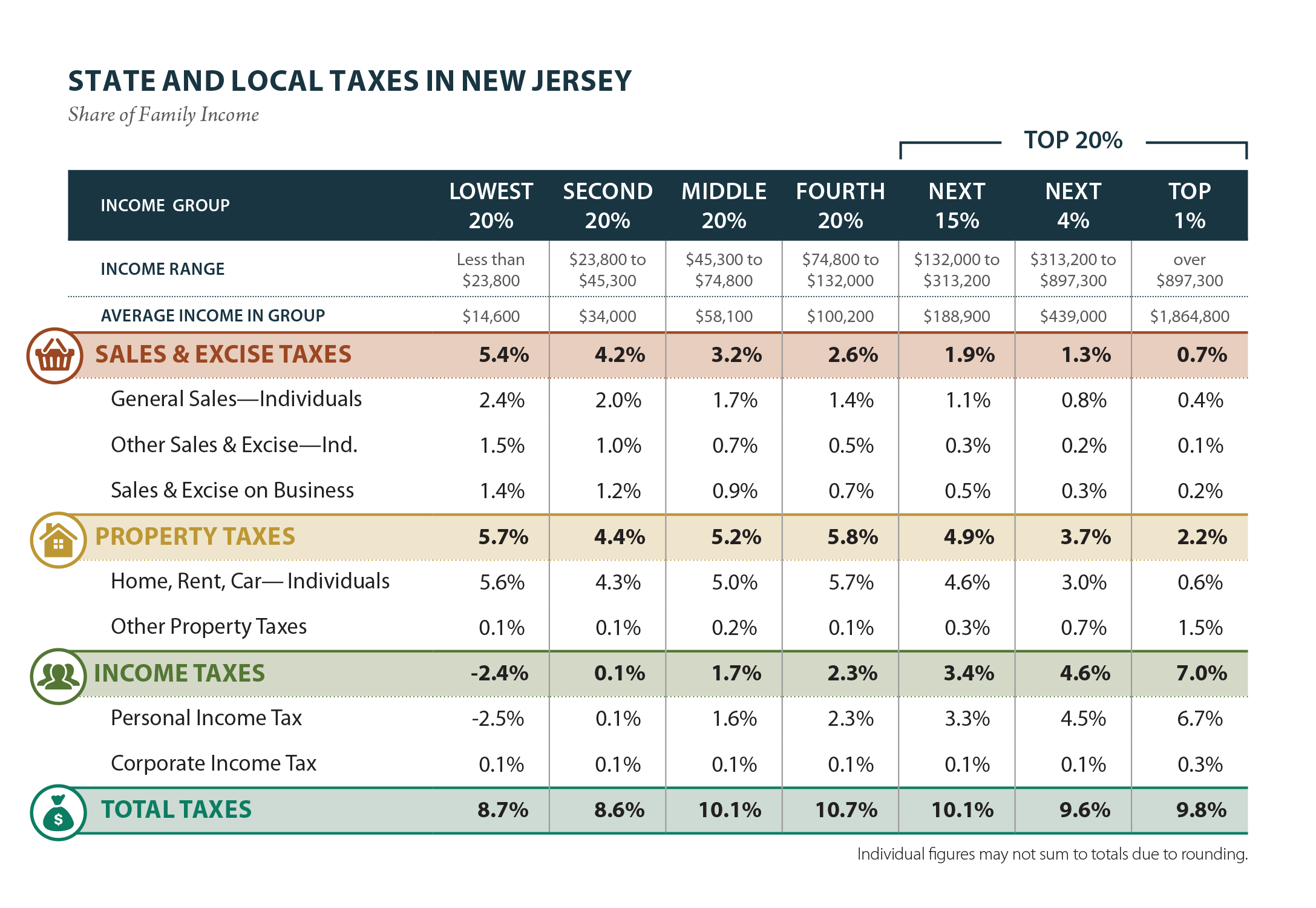

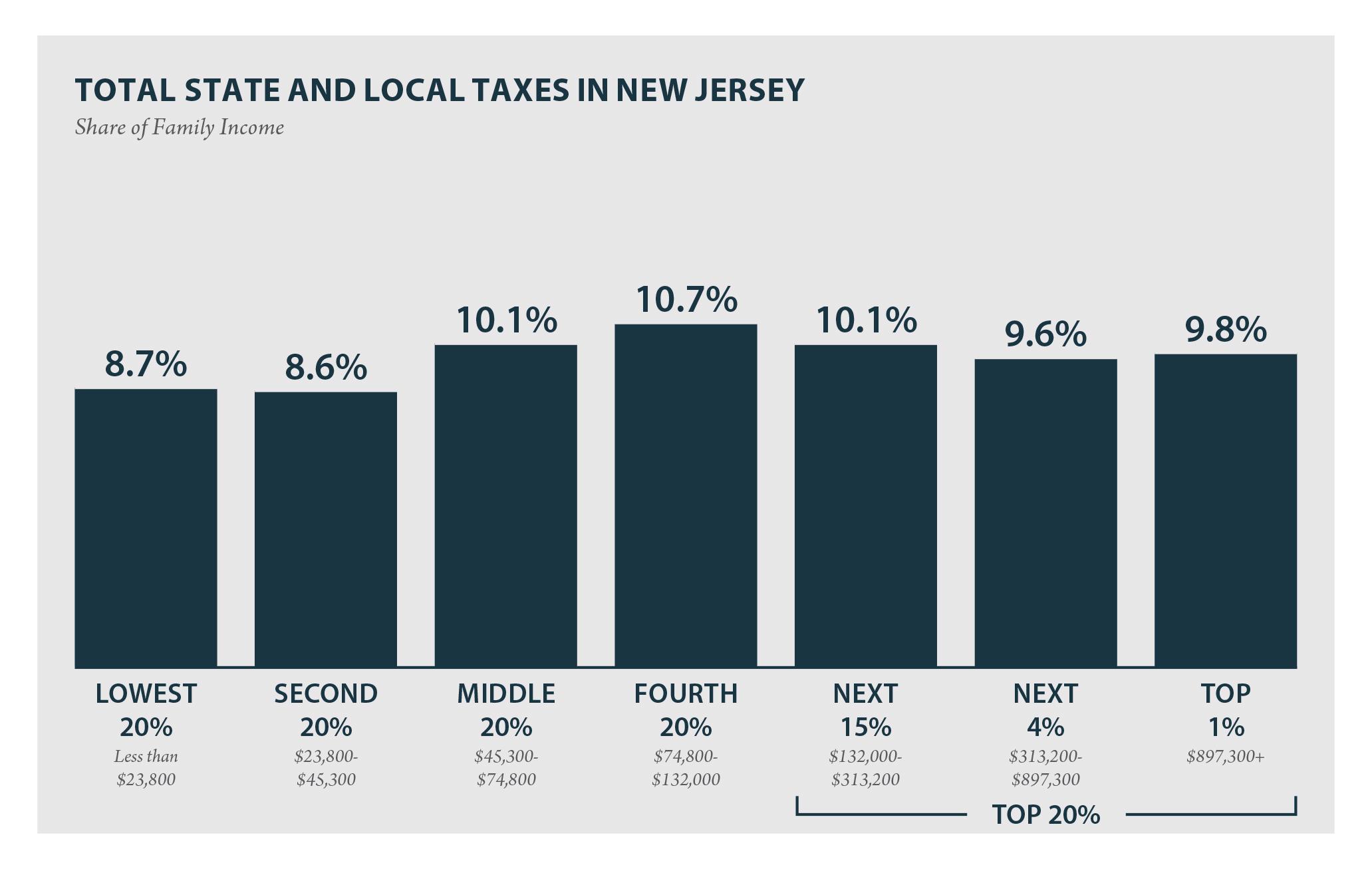

New Jersey Who Pays 6th Edition Itep

New Jersey Who Pays 6th Edition Itep

Stimulus Update New Jersey Homeowners Could Earn Up To 1 500 In Property Tax Relief Who Qualifies Gobankingrates

Where S My State Refund Track Your Refund In Every State

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Who Pays 6th Edition Itep

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Record High N J Budget With Property Tax Rebates Big Pension Money Tax Holidays Passes Legislature Nj Com

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

New Jersey Who Pays 6th Edition Itep

Murphy Legislative Leadership Announce Deal On Anchor Tax Relief Plan New Jersey Globe

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

New Jersey Who Pays 6th Edition Itep

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com

Murphy Enhances Proposed Anchor Property Tax Relief Program New Jersey Business Magazine

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future